Malaysian tax enforcement in 2020 - Updates. When you contact the Division of Taxation through the website we respond by email.

Instagram Photo By David Hogan Jr Jun 2 2016 At 5 15am Utc Malaysia Truly Asia Travel Instagram Beautiful Islands

Taxability of awards of compensation Service tax Treatment of bad debts Tax deductibility of borrowing costs.

. Place of exercise of control and management. The IGA was formally signed on 21 July 2021. 1341 Sales Tax 13411 Effective date and scope of taxation Sales tax is a single-stage tax imposed on taxable goods manufactured locally by a registered manufacturer and on.

These unintended and unplanned presence and absence have given rise to tax issues as follows. 2015 Tax Issues Current Malaysia Essay In. What is the change.

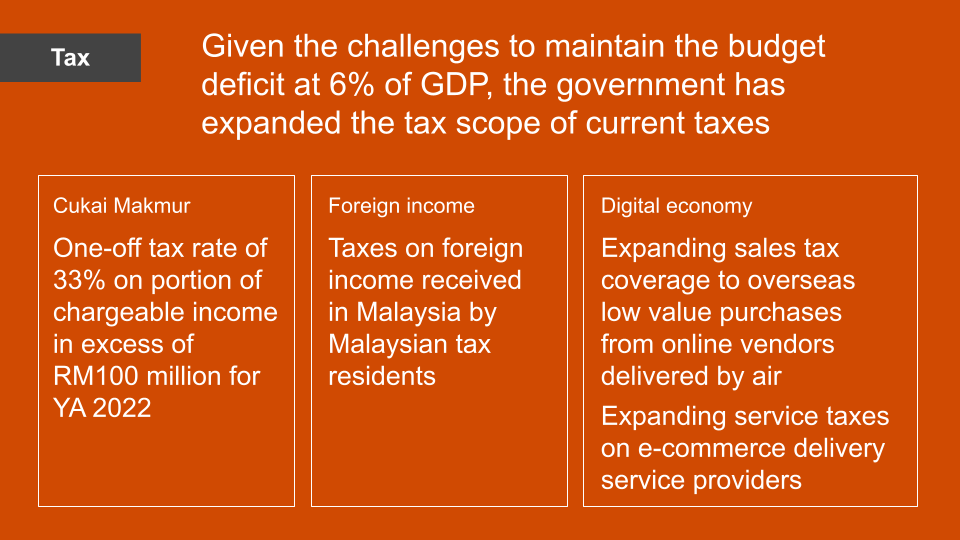

Beyond error penalties late submission of income tax returns may incur fines of up to 45 of payable tax. As such tax-resident persons whether individuals or corporations would be taxed on their foreign-sourced income received in Malaysia initially at a flat rate of 3 on gross amount received from Jan. Under the IGA reporting Malaysia-based financial institutions will provide the Malaysian Inland Revenue Board with the required.

Authored by our tax lawyers the book provides a practical and legal analysis of current issues faced by Malaysian taxpayers ranging from corporate taxpayers to company directors and local manufacturers. Sales tax fully waived for new passenger vehicles. Investment Banking for Family Business.

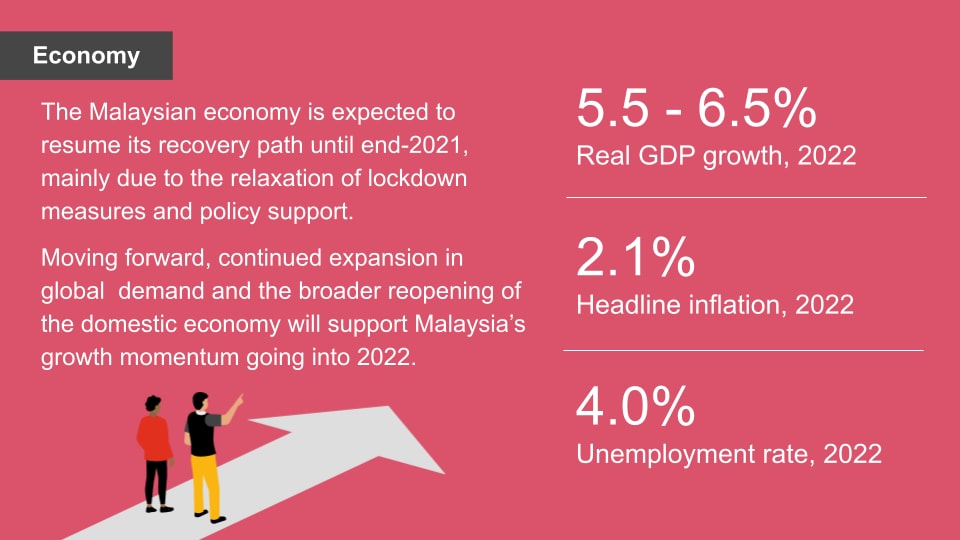

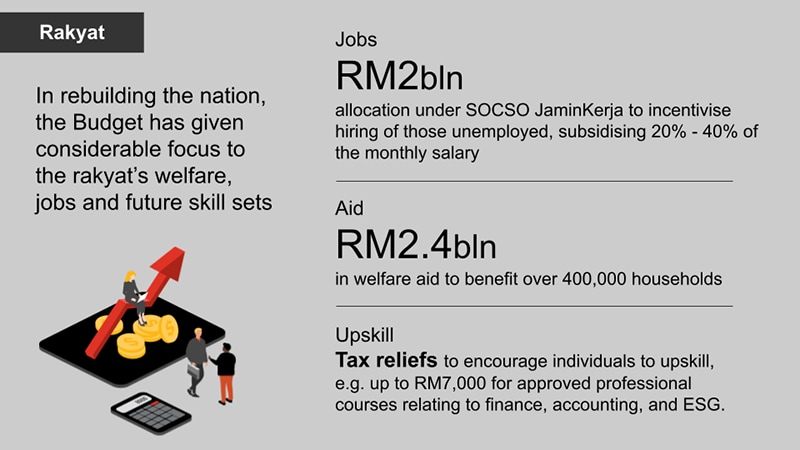

Up to RM3000 for kindergarten and daycare fees. Effective from January 1 2022 Malaysian residents will be taxed on their foreign-sourced income that is received in Malaysia. Explain the budget updates and other recent.

100 exemption on import and excise duties sales tax and road tax for electric vehicles. Review of income tax rate for individuals Currently individuals who are tax residents with a chargeable income of between RM50001 to. Spotlight on Current Malaysian Tax Issues we.

Xxii Figure I4 Gini Coefficient for Malaysia 19802015. Malaysia is a member of the British Commonwealth and its tax system has its roots in the British tax system. The current issue and full text archive of this journal is available at.

Areas of coverage include. Creation of a permanent establishment PE for an enterprise or entity. Reduce its current tax liability relative to its pretax accounting income.

Chapter 9 current issues in taxation 90 topic outcomes at the end of the lesson students should be able to explain the scope of charge for e-commerce business explain the type of business models. IRB may impose fines of up to 200 of uncharged tax if an error is discovered. Place of exercise of employment.

Malaysias taxes are assessed on a current year basis and are under the self-assessment system for all taxpayers. The ordinance was repealed by the Income Tax Act 1967 which took effect on 1 January 1968. Below are the relevant issues from the individual tax as well as an employers and employees perspectives.

Xxiv Figure I6 Indicators for Innovation 20082017. Xxiv Figure I5 External Trade for Malaysia 20002018 RM Million. During colonial rule the British introduced taxation to the Federation of Malaya as it was then known with the Income Tax Ordinance 1947.

Contemporary practices issues and future direction offers a clear and concise analysis of malaysias taxation system in terms. Tax residence in Malaysia. Through this measure the government hopes to comply with the scope of the OECD Forum on Harmful Tax Practices and could help remove Malaysia from the European Unions grey list of tax havens.

Xxi Figure I3 Household Income by Ethnics and Income Class. 603 6208 5945 E. Policy Framework Tax Accounting and Regulatory.

These unintended and unplanned presence and absence have given rise to tax issues as follows. Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers. Malaysia and the United States had on 30 June 2014 reached an agreement in substance on a Model 1 IGA to implement the Foreign Account Tax Compliance Act FATCA.

Government of Malaysia v Mahawira Sdn Bhd Anor Dato Nitin Nadkarni Partner Tax. 1 2022 to June 30 2022 and thereafter at prevailing income tax rates. RM9000 for individuals.

Place of exercise of employment. Administrative changes to the 2 withholding tax deduction by a payer company on payment to a resident individual agent dealer or distributor 3. Obviously it is vital to exercise care and consideration when filing income tax as an individual.

Explain the importance and role of double taxation agreements. 12022 - Time Limit for Unabsorbed Adjusted Business Losses Carried Forward 2. By States in Malaysia for January Until March 2019.

Determine the business income. In our August 2022 issue we cover the following topics. Tax SST Customs T.

An overview about Malaysia Taxation where all businesses need to pay income tax and other taxes depending on the business nature under Malaysia taxation. Family Business Reorganisation. The Finance Act FA has introduced significant changes to the Malaysian taxation system some of which are discussed below.

Tightening of Foreign-Sourced Income FSI Exemption Since year of assessment YA 1995 the income of any person derived from sources outside Malaysia and received in Malaysia has been tax-exempt the FSI exemption. Xx Figure I2 Household Income by States.

Regional Policy Networks Oecd Southeast Asia

Malaysia Issues Tax Exemption For Foreign Sourced Income

Six Key Challenges Facing Tax Leaders In 2021 And Beyond Ey Malaysia

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysian Households During Covid 19 Fading Resilience Rising Vulnerability

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Contoh Resume Student Uitm Resume Template Resume Job Resume Template

Printable Sample Rental Verification Form Letter Templates Letter Example Lettering

Editorial Cartoon Social Media Big Brother Belfast Waldo Republican Journal Editorial Cartoon Addition Art Editorial

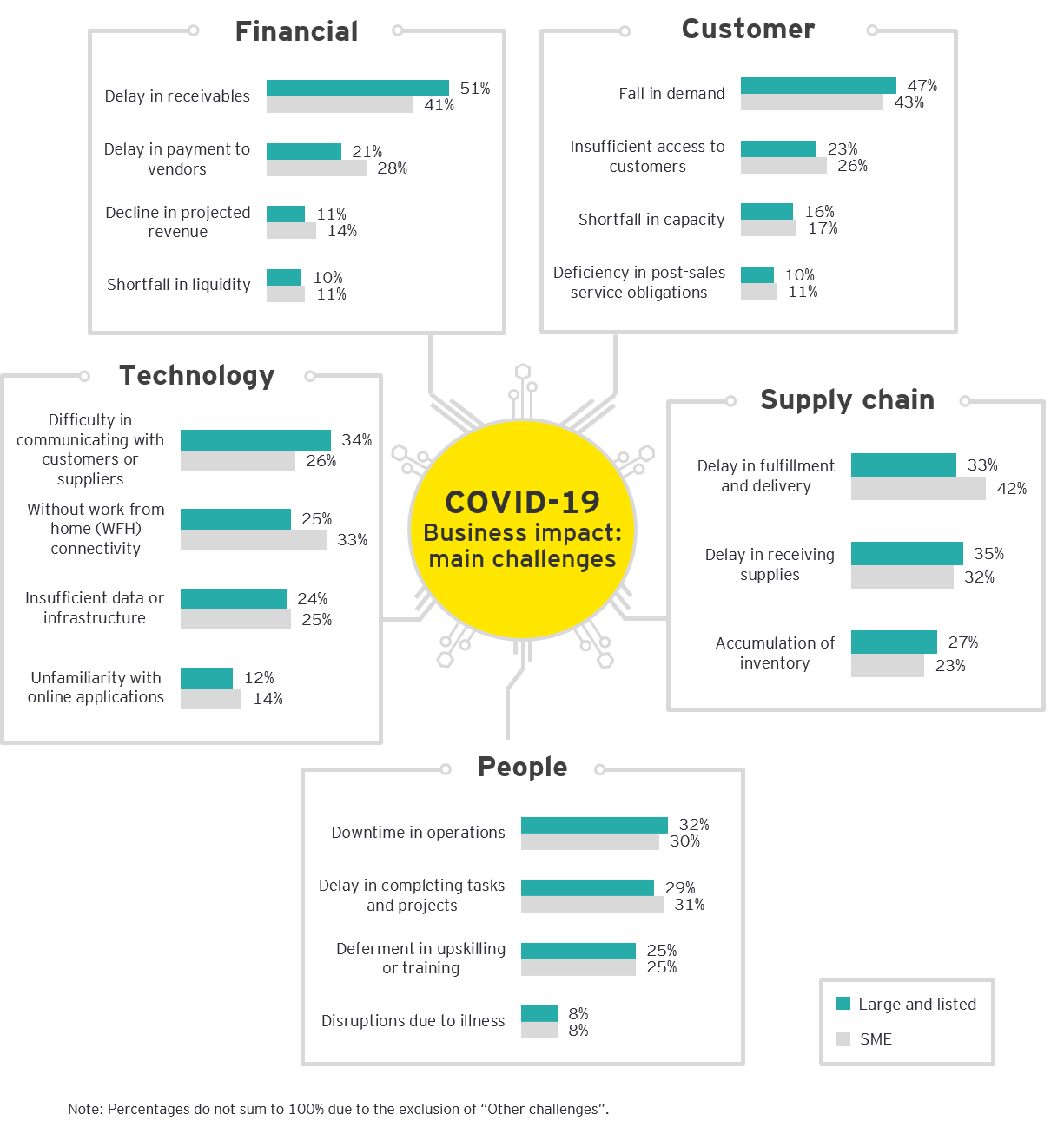

Covid 19 Impact On Malaysian Businesses Ey Malaysia

Gst In Malaysia Overcoming Adversity Throw In The Towel Frugal

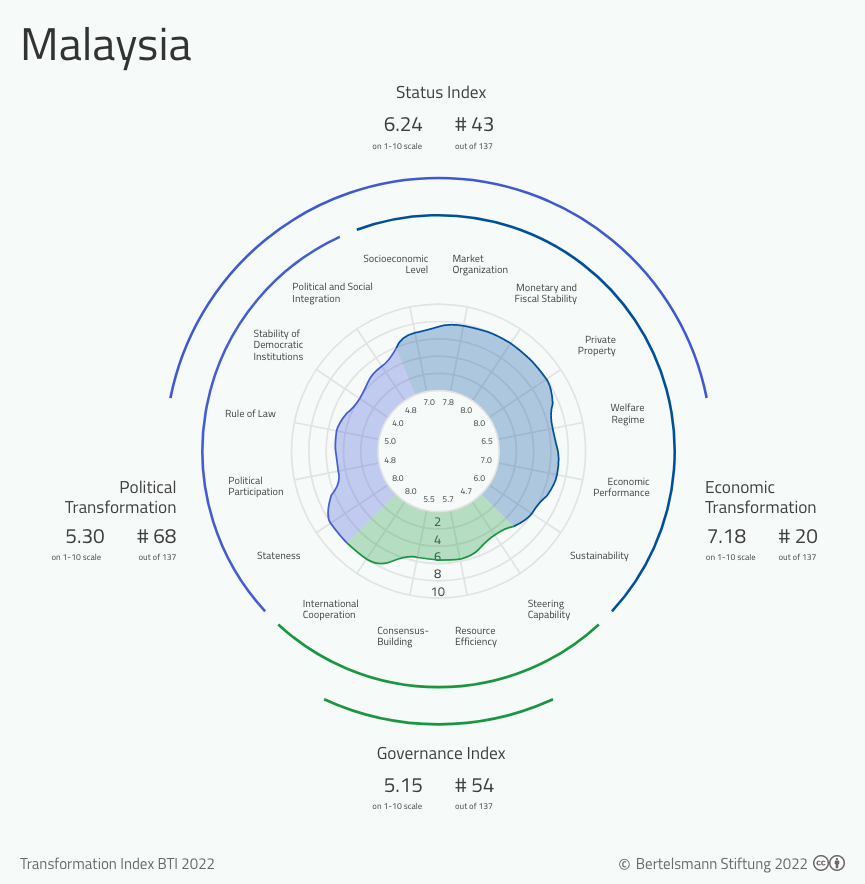

Bti 2022 Malaysia Country Report Bti 2022

/cloudfront-us-east-2.images.arcpublishing.com/reuters/SQ2RZSFVLNN23BTMEZHRQEX7BI.png)

Analysis Malaysia S Palm Oil Producers Adjust To Labour Shortages Higher Recruitment Costs Reuters

Chicago Property Taxes Hit Poorest Disproportionately Tax Debt Tax Attorney Tax Accountant

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Malaysia Resources And Power Britannica